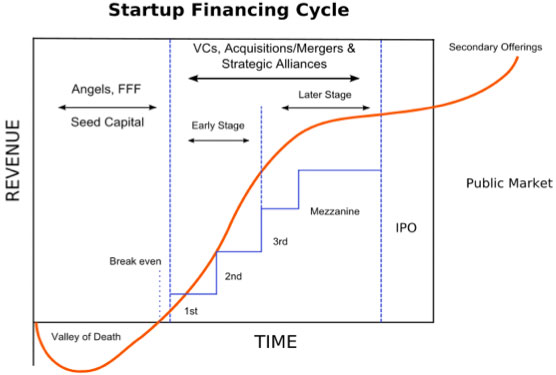

OneVest is an equity crowdfunding platform designed to connect early-stage startups with investors. As a registered broker-dealer (member of FINRA and SIPC), it offers a regulated and trusted environment for fundraising. The platform also offers a free co-founder matchmaking service to help entrepreneurs build strong founding teams.

ONEVEST REVIEW SUMMARY

√ Equity CrowdFunding Platform (Registered broker-dealer, member FINRA / SIPC)

√ Free startup service for co-founder matchmaking

√ 7.5% Fee on Raised Funds

√ $500 for establishment of an escrow account, $2,000 for Crowdcheck due diligence, and $150 bad actor check per covered person

√ Investors do not pay management fees/commissions on direct investments

√ Invest as little as $5,000

√ Over 35,000 startups and 15,000 investors registered

◙ SUPPORTED PROJECTS

OneVest focuses on early-stage startups across a variety of industries, including:

OneVest focuses on early-stage startups across a variety of industries, including:

-

Web & Mobile

-

Marketplaces

-

Social Networks

-

B2B Services

-

Fintech

-

Investment Management

Startup Evaluation Criteria:

OneVest uses a detailed, two-tier due diligence process that includes:

-

Background checks

-

Product testing

-

Competitive analysis

-

Go-to-market strategy review

Startup Requirements:

-

Experienced founding team (with industry experience or strong educational background)

-

Minimum of two full-time team members and credible advisors

-

Clear market opportunity and competitive advantage

-

Existing revenue or a scalable business model

-

Customer traction or signed contracts

-

Regulatory compliance (if applicable)

Offline Investors:

Startups can include offline investors (those sourced outside of OneVest) at no extra cost, provided the relationship did not originate from the platform.

◙ Supported Countries

OneVest accepts startup applications from around the world.

◙ About OneVest

-

Founded in 2014 through a merger of RockThePost and CoFoundersLab

-

Headquartered in New York City

-

Operates via North Capital Private Securities Corporation (NCPS)

-

Founders: Alejandro Cremades, Tanya Prive, Shahab Kaviani

-

Leadership has experience taking 4 companies public

-

Over 35,000 startup founders and 15,000 investors on the platform

◙ OneVest Fees

For Startups:

-

7.5% commission on funds raised through OneVest's investor network

-

$500 for escrow account setup

-

$2,000 for CrowdCheck due diligence

-

$150 per person for “bad actor” checks

For Investors:

-

No management fees or commissions on direct investments

Fund Disbursement

-

Funds are held in escrow until the minimum fundraising goal is reached

-

Once the goal is met, funds are released on a rolling close basis

◙ Campaign Duration

-

Standard campaign duration: 3 months

-

OneVest may extend campaigns by 1 additional month (maximum 120 days)

◙ Investor Features

-

Minimum investment: $5,000

-

No fees on direct investments

-

Dedicated investor relations team

-

Secure investor dashboard with e-signatures and investor verification

◙ Additional Platform Features

-

Personalized fundraising support from the OneVest team

-

Email marketing to the OneVest investor network

-

Targeted introductions to relevant investors

-

Co-founder matchmaking platform to help entrepreneurs find the right partners before launching

◙ CONTACT ONEVEST

Onevest Corporation, 401 Park Avenue South, Suite 10-001, New York, NY 10016, USA

OneVest General Info: +1 (646) 560-3221 | +1 (800) 420-7423

OneVest Info: This email address is being protected from spambots. You need JavaScript enabled to view it.

OneVest Website: www.ONEVEST.com

◙ OneVest Review

Crowdholder.com