FundersClub is a Venture Capital firm with more than 14,000 investors focusing on technology-driven startups from Silicon Valley and beyond.

◙ FUNDERS CLUB REVIEW SUMMARY

√ Equity Investing, FundersClub members invest through a single fund, and this fund is the only investor on the cap table

√ FundersClub typically invests between $200-500K in each startup (subsequent rounds may be possible)

√ 10% of the total raised funds are kept aside as an administrative fee

√ FundersClub receives carried interest on its investments

√ Startup Acceptance Ratio 2%

√ Invest as low as 3,000 USD, only accredited investors

◙ SUPPORTED PROJECTS

Funders Club focuses on technology-driven startups from Silicon Valley and beyond.

Funders Club focuses on technology-driven startups from Silicon Valley and beyond.

- ONLINE VC INVESTING FUND

Required Steps

■ STEP-(1) Startup Introduction

-FundersClub members refer companies to FundersClub

■ STEP-(2) FundersClub Committee

-FundersClub looks for companies showing strong traction and growth, and spends time vetting metrics in these areas

-FundersClub focuses on companies addressing a big market

-FundersClub's vetting process emphasizes the strength of the founding team

■ STEP-(3) FundersClub Panel

-After the FundersClub Investment Committee approves a company, a panel of investor members reviews the company and provides their opinion as to whether the company should launch on FundersClub

-The FundersClub Panel may also ask the company questions that they would want to know before investing, which is used to further analyze a company before launching it to all members

-The FundersClub Panel will vet the company's proposed valuation and/or terms and determine if they would be likely to be accepted in the market before listing the companies

■ STEP-(4) Launch Startup

-The company founders work with the FundersClub team and incorporate feedback from the Investment Committee and FundersClub Panel to build their profile on the FunderClub website

-Each fund is launched in Watchlist mode (Preview mode) for a while before launching

-After launching to Watchlist members and the FundersClub Panel members, the fund will normally launch to all members

◙ FUNDERS CLUB BACKGROUND

FundersClub is operating as an Online Venture Capital firm with a network of over 14,000 accredited investors. FundersClub is focused on high-potential, technology-driven startups from Silicon Valley and beyond.

Funders Club was founded in 2012 by Alexander Mittal and Boris Silver, and it is based in San Francisco, USA.

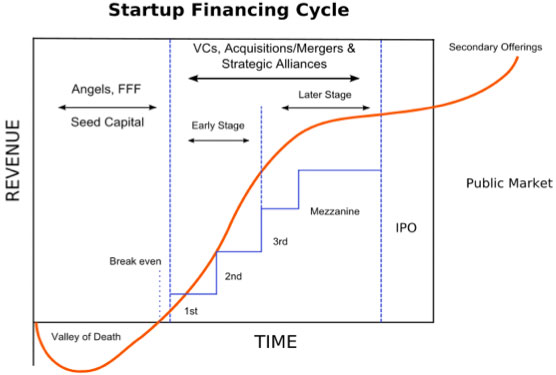

- Invest in early-stage private equity and venture capital

- Strategic partnerships with angel investors, incubators, and accelerators to share deal flow

FundersClub Due Diligence and Evaluation

FundersClub conducts due diligence and evaluation via the FundersClub's Investment Committee (comprised of entrepreneurs, angel investors, and VCs) and the FundersClub Panel (FundersClub investor members who generally represent the interests of the investor community)

◙ FUNDERS CLUB COST OF SERVICES

- 10% of the invested money is set aside within a fund to cover legal and accounting costs as an administrative fee

- FundersClub receives carried interest on its investments

◙ INVESTING WITH FUNDERS CLUB

FundersClub provides early-stage private equity and venture capital investment.

- Online Venture Capital investment

- $3,000 minimum when investing in startups (Only accredited investors)

- FundersClub members invest through a single fund, and this fund is the only investor on the cap table

- Insider access to invest in startup opportunities that are pre-screened bythe FundersClub Investment Committee

- FundersClub Panel (panel for members)

- Easily sign the required legal documents using e-signature

- Investors receive updates, press articles, and updates from the startup's founders

◙ FUNDRAISE TIMEFRAME

- From first contact to passing the FundersClub Panel typically takes 2-3 weeks of calendar time.

- Once the FundersClub platform selects a startup, it displays the startup’s profile to the investing community in "Preview Mode" for 1-2 weeks.

- Funding targets are frequently reached or surpassed within the first 48 hours to 1 week of fund launch, but the platform continues the listing if additional investment can be accommodated.

At the end of the campaign, the fund is closed, and the capital is transferred at the startup.

◙ OTHER FEATURES BY FUNDERS CLUB

-

Fund profile, detailed profile of each startup including key metrics, market information, customer testimonials, and a Q&A with the founder

-

Q&A Forum, members can post questions, and the startup's founders can reply

-

Weekly email updates with new opportunities/updates on existing opportunities

- Startups may use an email distribution list to contact investors directly

◙ CONTACT FUNDERS CLUB

FundersClub Inc., 1 Bluxome St. Suite 405, San Francisco CA 94107, USA

- Funders Club General Info: 1-888-405-9335

- Funders Club eMail Info: This email address is being protected from spambots. You need JavaScript enabled to view it.

- Funders Club Website: www.FUNDERSCLUB.com

◙ Funders Club Review

Crowdholder.com

|

|

|